Reviewing holiday results and putting them into context can be difficult. Occasionally what are perceived as poor results in a particular channel can actually be great (the reverse can also be true). I want to walk you through a holiday review of a Logical Position e-commerce client with unique situations that required some complex analysis.

High Level Numbers:

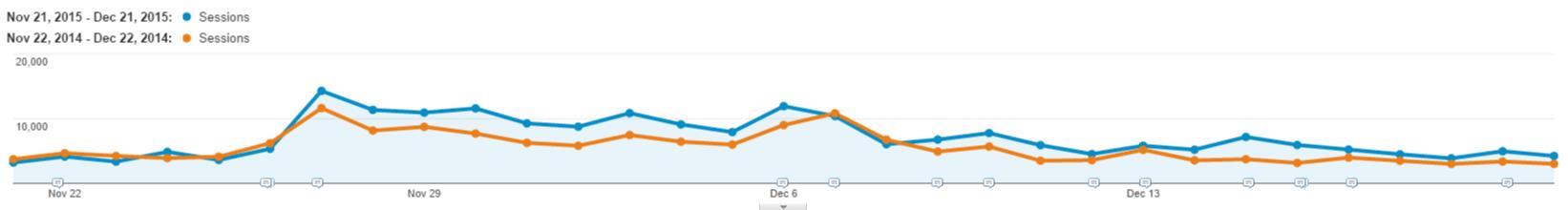

Using the same methods as outlined in a previous article, get to the channel results comparing year-over-year (YOY) data for your holiday period:

Notice all of the green arrows. This is a fast growing brand with good YOY metrics all around. Revenue was up almost 28%. With transactions jumping 68% and revenue only 28%, this normally would be a cause for concern, but because their margins are rather large (85%) and they introduced some lower priced products throughout the year, it’s probably okay. Here are the top session generating channels:

Set a Benchmark:

When analyzing a holiday period YOY, it is important to have a benchmark to compare things to, to understand whether the results are good or bad. At Logical Position, we prefer using direct traffic as the benchmark for client growth. As a general rule, when starting your analysis, channels that grew more than direct traffic did well, and channels that grew less than direct performed poorly. Direct traffic for this client had very healthy YOY growth: up 22% in sessions, 80% in transactions, and 41% in revenue. Using these guidelines, you can find areas to investigate for improvement.

The big outlier on the page is affiliates. If you weren’t aware of tagging issues in the affiliate program last year (incorrectly showing up as referral traffic in 2014 thus the 80% drop in referral revenue YOY as we fixed tagging), then that 2000% increase would be very impressive. Affiliates are up, but actually only around 15%. Email is up 54% and the largest driver of revenue they have, at 37.83% of total revenue. Organic traffic is the biggest laggard in the revenue growth department. Some of this is due to SERP changes, competitors pushing hard on SEO, and losing their internal SEO person. We had our affiliate team reach out for an in-depth review through the platform to better understand the lag in performance (note – our team quickly earned their business). Email is HUGELY important to this client and they have executed a phenomenal strategy for bringing customers back into their brand through email. This channel’s success is even more important to this brand as you will soon learn when we dig deeper into the paid search program.

Paid Search Results Initially Appear Poor:

Logical Position currently manages paid search for this client, so I personally am most interested in this channel, and how our team performed. This client has a good portion of revenue (15%) from paid media, but it’s by no means out of the ordinary. While site revenue was up almost 28%, paid search only increased 17.94%. Healthy direct traffic growth (YOY) usually indicates a great, growing brand, and the LP Enterprise team usually has the paid search outpacing the revenue growth target set by direct traffic. During this period, that was not the case and we need to explain to the client why.

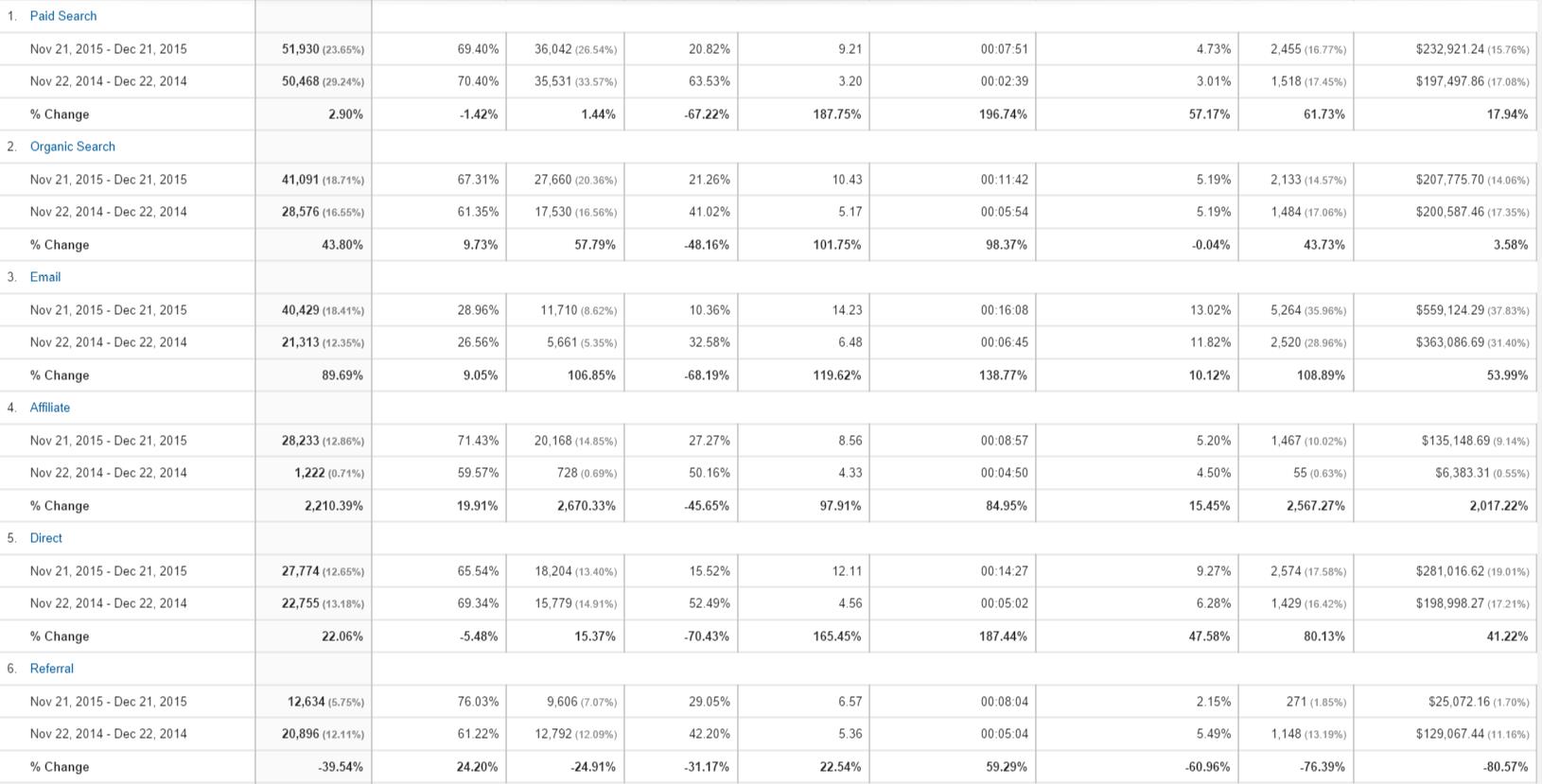

After adding revenue to the cost analysis report (Acquisition->Campaigns->Cost Analysis), we can quickly see that Google spent almost exactly the same amount as 2014, but drove 27.43% more revenue which generated a ROAS increase of 27.64%.

![]()

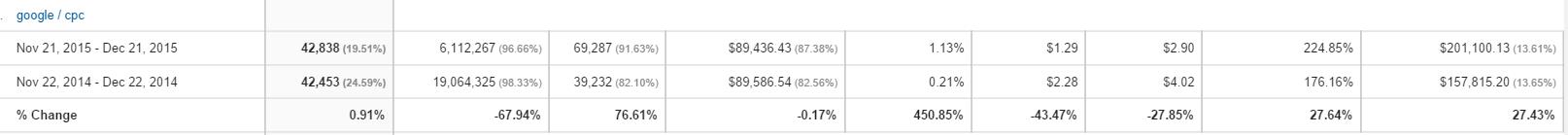

Bing shows a little different picture. Spent about 30% less, for 30% less revenue with ROAS only increasing 2.44%…not usually something we like to see.

![]()

Bing Analysis:

As Bing was down YOY, I will start there. After clicking into the bing/cpc source, I will filter the campaigns appropriately to only show me brand campaigns. This client has focused quite a bit of energy on their brand name and bringing in new customers through non-branded terms proves very costly. Knowing that, I’m assuming this much revenue drop had to come from branded traffic.

Branded impressions were up 71% YOY, which is usually a great sign. Everything else paints a very bad picture. Seeing only this data with no context, I’d fire my agency immediately. Thankfully we have other insight to put some context around this. The brand’s two largest retailers were not bidding on this company’s branded terms in 2014 on Bing. They jumped onto Bing this year, aggressively. We held position on brand terms well (1.04 in 2014 vs. 1.17 in 2015 – these numbers need to come from the AdCenter platform directly), but it came at a significant cost. CPCs were up 166%! The CTR drop is a testament to the power of those retailers and their loyal customer bases. They use points programs very well to insure that loyal base. Despite CPCs jumping 166% and the introduction of less expensive product lines, our revenue per click only dropped 34%. While the branded campaigns in Bing were down significantly, the ROAS was still 785% (down from 3246% in 2014). This still is a VERY healthy ROAS, but this drop meant we couldn’t pursue as many non-brand terms in Bing and still maintain the overall 200% ROAS the client needs, so we spent 31% less.

This client will need to come up with more reasons for their customers to buy directly from them rather than through their very powerful retailers without lowering pricing that could hurt the luxury brand image. Those retailers’ goals are to keep their customers and sell more products to them, not necessarily keep this brand’s customers buying that brand. Hopefully in the 2016 holiday we will be able to utilize ad text changes highlighting those reasons.

Google AdWords Analysis:

One big change in Google this year was the content network (display and remarketing ads). Last year we were able to prospect new customers at an acceptable ROAS using display ads, but the impact remarketing ads had on cost for this client made it prohibitive this year. Remarketing ended up with more revenue than last year on Google (barely), but without the display network adding to the revenue number, it hurt Google AdWords overall revenue growth. After removing Display revenue from 2014 holiday, Google AdWords was on par with Direct Traffic growth (over 38% YOY growth).

AdWords Branded Analysis:

By clicking into AdWords Campaigns (Acquisition->AdWords->Campaigns) and adding ROAS as a customization, I can filter by branded search. I won’t go into the details of how exactly I did this as we have a very complicated account structure and labeling system on this client. If your team and/or agency labels their campaigns with branded terms appropriately you should be able to filter the campaigns to show only branded traffic by searching in the Advanced filter:

For brand terms, this client had to spend over 100% more for only 61% more clicks. ROAS was down 48% on branded terms. Less expensive products on the site most likely contributed slightly to this. Also, after speaking to the account manager, there were some additional significant retailers that started carrying the brand this year. Online competition increased pretty dramatically. AdWords auction insights report will show how the competition changed YOY by advertiser on your branded campaign. Some of the same retailers from the previous year bid more aggressively as they realized the value of the growing brand. CPCs were up over 26% on branded terms as the competition for top positions intensified. Also, Google this year showed a 5-pack shopping box on their branded terms above the paid results in the middle of the page. This moved some traffic to shopping results.

AdWords Shopping Campaign Analysis:

For this company, many shopping terms are branded terms because of their positioning in the industry, but our account team was able to really push shopping pretty hard and generate some great increases year over year. While some of this was Google driving more clicks to shopping, the majority of the increase was due to our shopping structure and negative keyword sculpting. We were able to capture 4 of 5 shopping ads and 6 of 8 when the 5- and 8-packs were shown on page 1 of Google for branded searches.

Google AdWords Non-Brand Analysis:

The last portion of paid search: the non-brand terms. These are the people searching for the products without including a brand term. In this industry, the competitiveness and the tremendous level of customer research makes non-brand advertising much closer to branding. It is nearly impossible to drive profitable sales.

The client told us to use non-branded terms as branding (it will drive more branded searches later in the purchase cycle) and spend down to 2.25 ROAS for the AdWords account as that is still very profitable. Non-Branded acquisitions are almost always “new-to-file” customers and will be repeat clients more often than not. This future income is why there were willing to spend at a loss to ‘buy new customers’. In this case, the client spent $53k to get $9,800. While dramatically better than the year before (up 142% in revenue and up 126% in ROAS), it was a huge money loser. We are going to have a conversation with this client about other areas of marketing that might make more sense. For example, dollars go much further on YouTube for branding purposes and may make a better play next holiday season. Regardless, the client is very happy with the results (which is the real goal in the end), as their non-branded paid search client acquisition cost is still one of the lowest among their marketing channels.

Final Thoughts:

By showing the client our profit maximization calculations, they agreed that next year they would push harder on branded terms, which means lowering their targets on branded terms. The higher positions (even moving from a 1.4 to a 1.1) can yield a good portion of clicks and much higher revenue during a high conversion time like the holiday period. Our calculations explained that while the ROAS might be a little lower, the overall profit to the company will be higher because of the additional volume of sales.

Next year, it may make sense to lower spend on non-branded terms and find other avenues to push for new customers. Even some premium placements among the appropriate affiliates channels could lead to a higher ROI and more new-to-brand customers. Our teams will be experimenting this year before holiday to find additional channels that may perform at a better cost-per-acquisition than non-branded paid search. Also, we must constantly be aware of the impact new, deep pocketed advertisers will have on our campaigns. We defended well, but the cost impact is noticeable. We have our work cut out for us in planning for next holiday season, but we are looking forward to the planning involved with our team and the client before the next holiday season gets started!

If your agency is not doing this sort of analysis for you, or you don’t have an employee/agency assisting you, please reach out and let’s talk. I love diving into data and helping companies strategize on finding ways to win. You can reach me at ryan.garrow@logicalposition.com or 503.305.5583. I look forward to helping you win online!

Logical Position, an Inc. 500 digital agency supporting 5,000+ clients across North America. LP is the proud recipient of Google’s Lead Generation Premier Partner of the Year and Microsoft's Global Channel Partner of the Year 2024! The award-winning agency offers full-service PPC management, SEO, Paid Social, Amazon and Creative Services for businesses large and small. As a Google Premier Partner, Microsoft Elite Partner & Meta Business Partner, LP is in the top 1% of ad spend managed across platforms.