In a surprising move shaking up the digital advertising ecosystem, Amazon has officially withdrawn from Google Shopping ads across all markets. While Amazon has been gradually decreasing their Google Shopping investment since mid-2024, they have officially pulled the plug as of late July 2025—marking a turning point for Google’s product advertising landscape. For advertisers and marketers alike, especially those leveraging Shopping Ads, the implications are both immediate and far-reaching.

What Happened

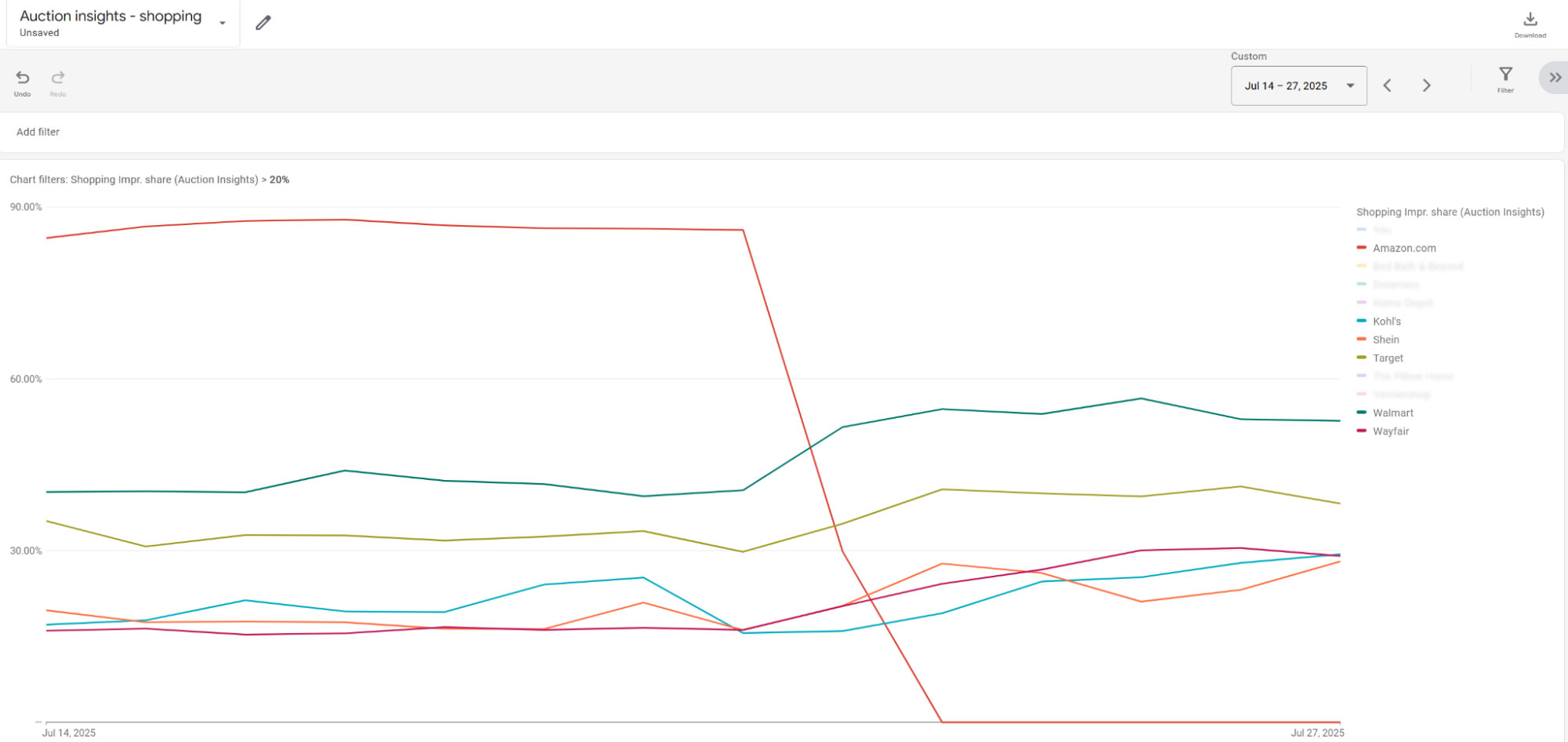

After steadily reducing its footprint over the past year, Amazon has now fully exited Google Shopping (Product Listing Ads) across more than 20 international markets. This is Amazon’s most significant pullback since its temporary pause during the pandemic in early 2020. This is significant, as it’s been speculated that Amazon had accounted for nearly 30% of all Shopping ad impressions in the U.S. alone—a market share that commanded massive bidding power and visibility.

The change became evident in July 2025 (graph below) when Amazon’s ads disappeared seemingly overnight from Shopping auction results. For many advertisers, this cleared a space long dominated by the retail behemoth.

Why Did Amazon Exit?

Several motivations appear to be driving this decision:

- Cost Efficiency: Amazon presumably spent over $50 million annually on Google Shopping ads. Shifting those dollars to internal platforms could improve margins and operational control.

- Platform Power Play: Amazon continues to prioritize keeping customers on its own platform and within its own ad ecosystem. By stepping back from Google, Amazon is signaling that it prefers to shape the full customer journey—from search to sale—within its own domain. Plus, Amazon may be hoping that sellers who feel a decrease in traffic following the pause may decide to increase their investment in Amazon ads to recover some of the lost volume.

- Tensions Between Giants: Over the years, Amazon and Google have had several points of friction—from hardware delistings to YouTube device conflicts. This may be part of a larger strategic realignment between the two tech titans.

What This Means for Advertisers

Amazon’s departure presents a rare opportunity for smaller and mid-sized advertisers:

- Lower CPCs: With Amazon out of the auction, cost-per-clicks may decrease, especially in competitive product categories.

- Increased Impression Share: Brands that were previously crowded out—especially those with limited budgets—may now see greater visibility and return on ad spend.

- Room for Expansion: Retailers like Target, Wayfair, SHEIN, and Walmart may fill the vacuum, but DTC brands and specialty eCommerce stores also stand to gain.

At Logical Position, this shift presents an opportunity to help clients seize prime digital real estate before larger players recalibrate their strategies.

Strategic Impacts on Amazon Sellers

While Amazon’s internal ad platform continues to grow, its pullback from Google may reduce off-platform exposure for its third-party sellers. Brands relying solely on Amazon traffic should consider diversifying their advertising efforts across:

- Google Shopping

- Microsoft Ads

- Meta (Facebook/Instagram)

- TikTok and Pinterest

At Logical Position, we’ve long advocated the benefits of an omnichannel approach and this shift underscores exactly why.

What Next?

If you’re managing Shopping campaigns, we’re working with our clients on the following:

- Audit campaign performance: Monitor CPCs, impression share, and conversion volume post-Amazon exit.

- Scale what’s working: Consider increasing bids or budgets in campaigns that now have lower competition.

- Refine product feeds: With more eyes on your listings, feed quality and merchant reputation matter more than ever.

- Diversify beyond Amazon: Amazon sellers should ramp up Google and social ad investments to hedge against volatility.

- Monitor auction insights reports: Closely observe the competitive landscape surrounding your business and how your competitors have reacted to the change, while also keeping an eye out for if Amazon returns.

Looking Ahead: A Changing Ad Landscape

Amazon’s exit may seem like a shock today, but it could signal a broader trend: major platforms leaning into walled gardens and self-contained ecosystems. As user data privacy becomes paramount, advertisers will need to navigate a world of fragmented attention and first-party data strategies.

For Google, this is a blow. For savvy advertisers? It’s a windfall—if you act quickly.

Need Help Seizing the Opportunity?

At Logical Position, we specialize in Google Shopping campaign management, feed optimization, and cross-platform advertising strategy. Our team is already helping clients adjust to this new landscape—and we’d love to help you next.

If you need a free account review, let’s talk about how to make the most of this shift.