The pandemic defined last year’s holiday shopping season. Brick and mortar traffic plummeted as holiday shoppers avoided crowded malls. At the same time, a new wave of consumers began shopping online, driving e-commerce revenues to record heights. As we approached this year’s Turkey Five, or the period between Thanksgiving and Cyber Monday, many advertisers expected to see a repeat of last year.

Now that those five days are behind us, a somewhat uneven picture has emerged along with several common trends, including unexpected results from the biggest shopping day of them all.

A Surprising Decline

On Black Friday, consumers rang up $8.9 billion in online purchases, down from $9 billion in 2020, marking the first time ever that Black Friday sales have declined year-over-year. Thanksgiving sales were also flat over 2020 at $5.1 billion.

This unusual outcome was partly due to consumers returning to brick-and-mortar stores. Traffic to physical retailers was up 47% over last year, but still down 28% from pre-pandemic levels. Supply chain concerns also prompted many consumers and retailers to begin their holiday shopping activity earlier in November.

These factors all played a role in the results Logical Position saw on our three leading advertising platforms — paid search, paid social and Amazon. As competition heated up for fewer online buyers, increased costs spilled over into the paid search space.

Paid Search Costs Increased Dramatically

Many businesses, not including our clients, pegged their holiday fortunes on a repeat of last year’s revenue activity. However, as these advertisers encountered softer than expected demand, they continued pushing ad spending to try and meet their financial forecasts. This activity drove Cost-Per-Clicks (CPCs) 30% higher on the Google and Bing Networks during the 2021 Turkey Five period.

These results continue a year-long trend of dramatically higher CPC costs. Some believe that automation is driving higher costs as more sophisticated artificial intelligence increases bids to capture the attention of people it believes are about to buy. Regardless of the source, the days of easy e-commerce revenue are coming to an end as competition grows increasingly fierce.

Mobile Traffic Saw Big Jumps

Consumers continued making more and more of their holiday purchases from their mobile devices.

- Smartphones accounted for 44% of all sales on Black Friday, up 10.6% year-over-year.

- Smartphones also made up 62% of all visits, meaning many consumers shopped on their phones before making purchases on their desktops.

LP Clients Still Won the Turkey Five

Despite these challenges, LP clients saw plenty of success during this pivotal shopping season. They heeded our predictions that Thanksgiving wouldn’t see the same growth as it did in 2020, so we encouraged them to start their promos and advertising spends early to capture demand while incorporating email and SMS to help close sales.

Paid Social Media in Transition

While paid search was more expensive this year, Facebook and Instagram were in the midst of an adjustment phase that impacted the effectiveness and clarity of paid social advertising. Recent privacy changes on the iOS platform have impacted advertisers’ ability to target and remarket to qualified audiences. One byproduct of these changes is that Facebook is underreporting results by 15-20%, which can dramatically affect return-on-ad-spend (ROAS) statistics. Despite these headwinds, LP’s social team built strategies that helped our clients navigate the Turkey Five season smoothly, as evidenced by the following:

2021 Metrics and CPM Trends

Advertising costs were up, and revenue was down on paid social during the Turkey Five shopping period.

- CPMs for LP clients were up 25% year-over-year ($21.61/$16.40).

- Total revenue generated from Facebook ads was down about 20% year-over-year. We believe this is due to the significant increase in CPMs this year, and Facebook underreporting on its platform.

Performance Trends Per Day

The early start to the holiday shopping season also impacted purchasing activity during the Turkey Five. We anticipated this possibility and encouraged our clients to run promos earlier in November to gain momentum going into Thanksgiving. That approach allowed ads to move through the learning phase and pick up sales before CPM’s spiked.

- Traditionally, Black Friday and Cyber Monday outperform the two days in-between by about 25%. This year we saw ad generated revenue almost two times higher on Friday and Monday compared to Thanksgiving and the weekend days.

- Cyber Monday was our clients’ top-performing day this year, with Black Friday a close second. On-site conversion rates were almost identical on those two days.

- CPMs were about 6% higher on Black Friday, leading to 6% lower ROAS than we saw on Cyber Monday.

CPM Trends Per Day

As retailers competed to capture holiday buyers, advertising costs spiked on Black Friday and Cyber Monday.

- Thursday, Nov. 25 – CPM: $19.42

- Friday, Nov. 26 – CPM: $24.10

- Saturday, Nov. 27 – CPM: $21.40

- Sunday, Nov. 28 – CPM: $20.83

- Monday, Nov. 29 – CPM: $22.62

Mobile vs. Desktop Allocation

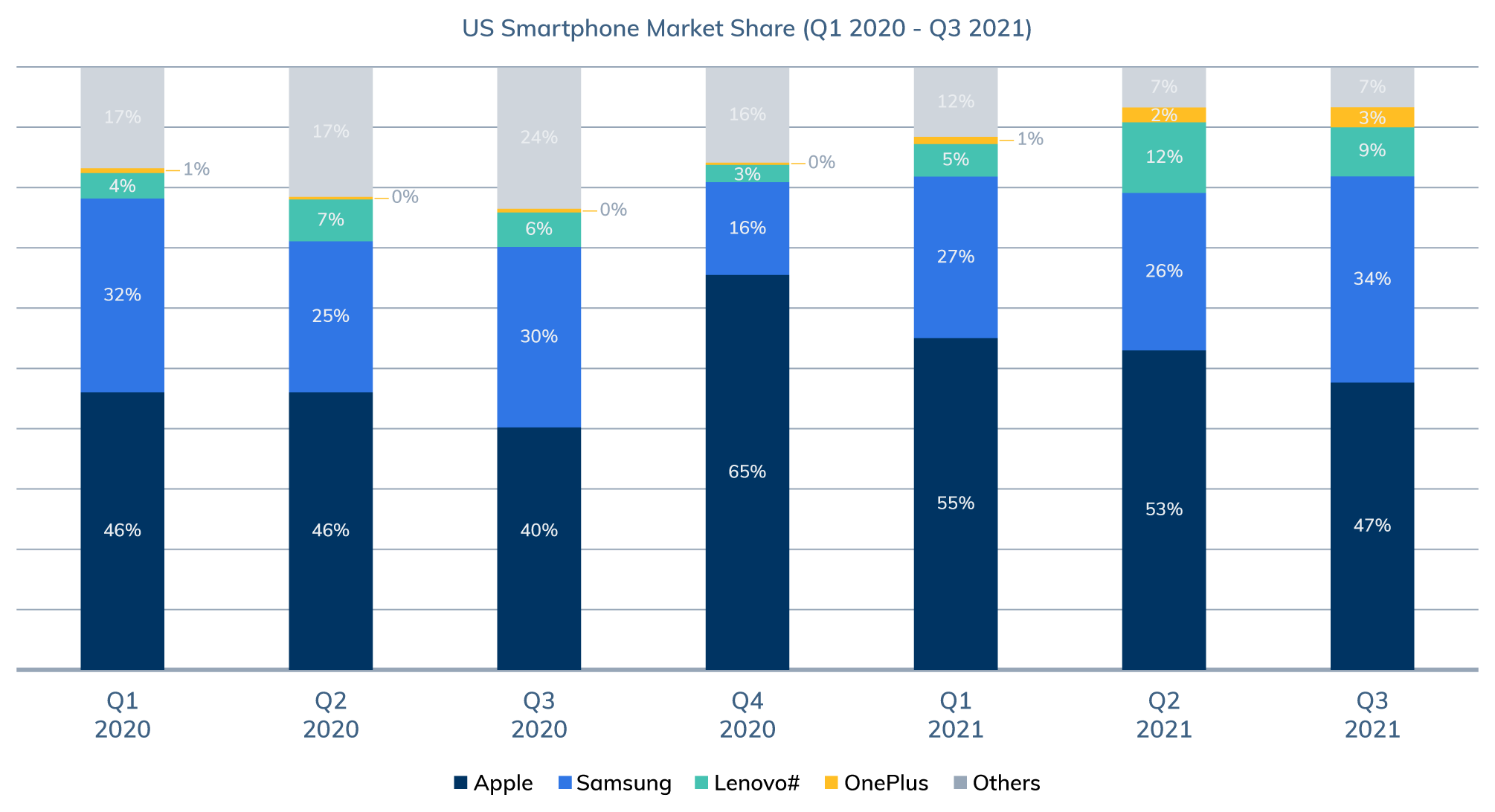

This year, we noticed some interesting shifts in spend allocation between iPhone and Android devices. As you can see in the below table outlining data from Counterpoint Research, Apple’s smartphone market share has increased year-over-year, so the expectation would be that spend allocation on Android devices would decrease. Instead, we saw the opposite, with spending on Android devices rising from 20% last year to just over 35% of total spend this year.

Allocated spend on desktops also doubled from 5% to 10%. This data clearly indicates that Facebook is allocating increased spending to these devices due to targeting and attribution limitations caused by the iOS 14 updates earlier this year.

Source: MOBILE DEVICES MONITOR – Q3 2021 (Vendor Region Countries)

A New Ad Creative Strategy Paid Dividends

This year, LP shifted its focus to incorporate greater creative variation in its campaigns. We prioritized use of static images as the primary attention-getters in promotions. Consequently, those images proved to be our top performers, especially in remarketing campaigns where users were already familiar with the brand. By using varied creative images, advertisers could scale their audiences horizontally to reach users who respond to specific ad types, allowing Facebook’s algorithm to adapt accordingly.

Omnichannel Tactics Are Critical

One of the most significant challenges our paid-social team faced this year was parsing delayed purchase data. Thanks to those new iOS privacy rules, data can be delayed anywhere from 24-72 hours between when a purchase occurs and when the event is sent to Facebook. A delay of that magnitude makes tracking ad performance difficult over short periods. That’s why it’s more important than ever for Facebook media buyers to cross-reference Google Analytics data via UTM parameters to make budget adjustments and analyze performance data.

Increased Costs and Higher Revenue on Amazon

The Turkey Five trends on Amazon mimicked what we saw in paid search and social: buying activity began earlier, competition for buyers was at an all-time high, and advertising costs increased. Here’s how activity on the world’s largest e-commerce platform broke out.

Total Metrics and CPC Trends

Like every other platform, this year advertising costs also increased on Amazon. Fortunately for LP clients, those increases also accompanied generous revenue growth.

- LP client CPCs through November were up 12% year-over-year ($0.74 vs. $0.66).

- CTR improved 27% over 2020 (0.37% vs. 0.29%), likely due to increased ad inventory and a push into high-CTR video content.

- Total revenue from Amazon advertising was up about 45% over 2020.

- Our client’s average conversion rates and ROAS remained steady year-over-year.

Performance Trends Per Day

Typically we see a pre-holiday slump in early November. However, Amazon holiday shopping picked up almost immediately after Halloween this year. As a result, ad spending jumped to holiday levels earlier than ever as traffic, CPC, and sales began increasing.

- As with Facebook, returns on Black Friday and Cyber Monday are typically 25% higher than the two days in-between. This year, returns on Friday and Monday were twice as high as the other three Turkey Five days.

- Cyber Monday was our highest traffic day of the holiday season so far.

CPC Trends Per Day

Unlike Facebook, Amazon’s advertising costs remained steady throughout the Turkey Five.

- Thursday, Nov. 25 – CPC: $0.82

- Friday, Nov. 26 – CPC: $0.83

- Saturday, Nov. 27 – CPC: $0.80

- Sunday, Nov. 28 – CPC: $0.80

- Monday, Nov. 29 – CPC: $0.84

Final Takeaways

Global supply chain slowdowns had a big impact on Amazon shopping this year and will continue to affect behavior throughout the rest of the holidays. If retailers run out of stock early, the holiday shopping season could be shorter than usual. In that event, smaller sellers who still have available stock on hand could see a big sales boost.

Finishing the Season Strong

Despite disappointing growth during the 2021 Turkey Five season, experts still predict November and December numbers will be up between 8.5% and 10.5%, which would set a record for year-over-year growth. With that in mind, here are three tactics retailers can still use to finish the year strong:

- Push to the last ship day. Stay aggressive with advertising as long as customers will receive their orders before Christmas.

- Focus on gift cards. The holiday season isn’t over until Saturday, Dec. 26. Many shoppers purchase digital gift cards as an ultra-last-minute gift, so ensure websites have these options front-and-center.

- Don’t forget about the last week of the calendar year. That week between Christmas and New Year’s Day is when many people spend the cash and gift cards they receive as presents. During this period, a specially timed promotion could bring in a nice jolt of unexpected revenue.

Into 2022 and Beyond

As retailers move into the new year, e-commerce will become increasingly challenging. Rising advertising costs on Facebook, Amazon and Google will continue eating into profit margins, which is already playing out in the marketplace. Since October, large retailers have seen 22% higher revenue growth on average than small retailers. To succeed in the competitive and more expensive environment, and prepare for next year’s Turkey Five, smaller businesses need to differentiate themselves from their larger competitors while building direct channels and customer loyalty programs.

Until then, keep pushing through the end of the year. Customers are looking for products like yours. Follow the data and make intelligent adjustments. We know it won’t take long for them to find you.